Commercial Real Estate Investment

Value-Add Commercial Real Estate Investment

Value-add commercial real estate investment is the potential for higher returns by increasing the cash flow of the property. The improvements made to the asset are aimed at increasing income or decreasing expenses, or both. Examples of income-increasing activities include raising rents, performing renovations, or adding ancillary income streams. To evaluate the profitability of these investments, investors need to consider the trade-offs involved in the improvements, such as whether the cost of renovations will justify the increase in income or occupancy rate.

Value-add investments in commercial real estate are often pursued by investors seeking higher potential returns than what they would receive through more conservative investment strategies, such as core or core-plus investments. These types of properties may have lower occupancy rates or require significant capital expenditure for physical improvements and major renovations, but they also offer opportunities for increased cash flow through active asset management.

Based on the provided web search results, Core Plus is a moderate risk/moderate return investment strategy that involves investing in core properties with some enhancement or value-add component. Core Plus properties are typically of slightly lower quality than Core properties, but still maintain a strong tenant base. These properties are purchased more aggressively, with more debt than Core properties, and are associated with a low-to-moderate risk profile. Returns from Core Plus investments typically range from 8% – 12% annually through a combination of income and some growth.

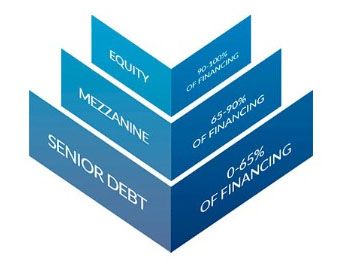

Core Plus investments are generally considered to be a subset of commercial real estate equity investments and are one of the three primary strategies, the other two being Core and Value-Add. Core properties are high-quality/low-risk assets that offer stable and consistent cash flows. They are typically characterized by low leverage, new or like-new construction, high-end finishes, and no major structural or operational issues.

In contrast, Core Plus properties are slightly lower in quality than Core properties and may be in suburban or secondary metropolitan areas. The tenant may not be quite as high quality, or may not have a rent guarantee from a high-quality national company. However, cash flow in a Core Plus property might be more variable, but it can also produce higher returns.